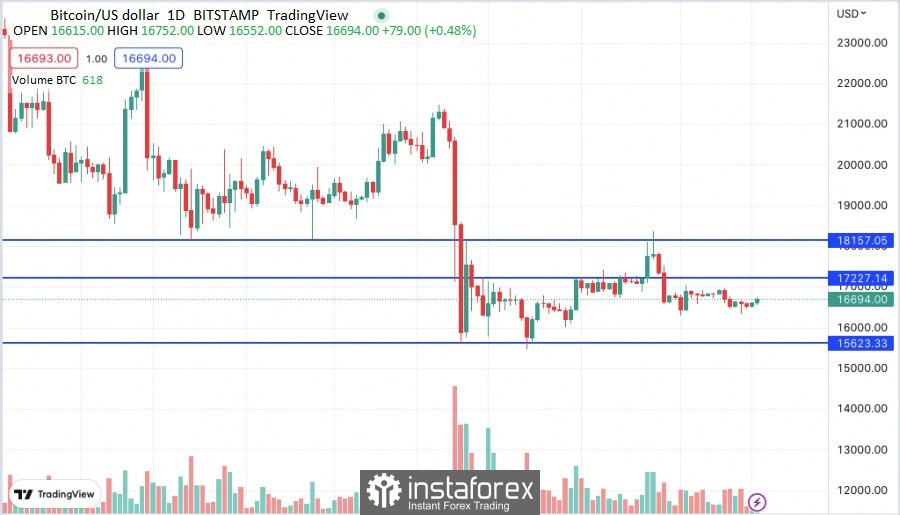

Bitcoin started the year with slightly higher volatility without changing technical benchmarks. So far, quotes have failed to rise above $17,000.

The coming months do not bode well for cryptocurrencies, with a recession looming. Nevertheless, analysts are trying to find signs of an approaching bull market.

Whale ratio gives a bullish hint

On-chain data shows that the BTC exchange Whale Ratio has been declining recently. There is speculation that this is bullish for Bitcoin and for the crypto market as a whole.

An analyst in a CryptoQuant post drew attention to the "exchange whale ratio." This is an indicator that measures the ratio between the sum of the top 10 Bitcoin transactions on exchanges and the total exchange inflow.

Since the 10 largest deposits to exchanges usually come from whales, we can deduce what part of the total exchange inflows comes from these big players. Thus, the high values means whales are making up a high part of the inflows right now.

One of the main reasons investors deposit to exchanges is for selling purposes. This kind of trend can be a sign of heavy dumping from this group of players, and could therefore be bearish for the value of the crypto. Low values of the ratio imply whales aren't making a disproportionate contribution to the inflows currently, and this can be a good sign for BTC.

The 72-hour moving average for Bitcoin exchange rose in the first half of the year, showing that whales were increasingly dumping the coin as the price slumped. By the third quarter of 2022, however, there was a slowdown in the metric, and in the last few months of the year, the trend reversed and the indicator started a downtrend.

This means that the whales have been reducing their selling pressure lately. Interestingly, a similar pattern was observed between late 2018 and early 2019. In that cycle's bear market, this trend in the whale ratio trend coincided with the price bottoming out.

Once the whale ratio finished its decline in that bear market, Bitcoin finally began to rise. If the same trend follows this time as well, then the current downtrend of the whale ratio could also lead to some bullish relief for BTC investors.

Recession looms

In an interview with the IMF Managing Director this year, there is an expectation that one third of the global economy will be in recession.

IMF chief Kristalina Georgieva stressed that the global economy will face a difficult year, with conditions tougher than in 2022. This will be caused by a slowdown in growth in the world's three largest economies: the U.S., EU and China.

In her opinion, the U.S. could avoid a recession, but the EU economy has already slowed. The countries have been hit hard by the outbreak of war between Ukraine and Russia. China, for its part, is having a tough year.

According to Georgieva, emerging markets will also be hit hard by the slowdown in major economies. The slowdown is becoming a global trend, thereby bringing down the entire global market.

Meanwhile, China remains under attack by a pandemic. China canceled the "zero-Covid" policy in December after a huge number of positive cases. People were forced to stay home and businesses shut down. Economic activity in the country was at its lowest since 2020, when the pandemic first struck.

The global recession, the IMF has determined, will affect one-third of all economies, and there is a 25% chance of global GDP growing by less than 2% in 2023.

Purchasing managers' index data for the manufacturing sector released Monday showed low values in Europe, Turkey and South Korea. Similar dismal statistics are expected for Malaysia, Taiwan, Vietnam, the U.K., Canada and the U.S. in reports due out Tuesday.

What impact will all this have on Bitcoin and the digital asset market? The cryptocurrency market will face the consequences of the global economic slowdown. The recession will force investors to look for other options to invest in. Nevertheless, it is possible that some investors may see investing in Bitcoin as a hedge against a global recession.