MobileTrader

MobileTrader: trading platform near at hand!

Download and start right now!

31.03.2025 01:01 PM

31.03.2025 01:01 PMEurope's gas sector is entering a critical phase, as the end of the heating season sets the stage for refilling storage facilities, which are now two-thirds empty after the winter months.

Typically, traders play a central role in replenishing reserves, since summer gas prices are generally lower, allowing them to profit by storing large volumes for sale during the next heating season when demand rises again.

However, industry experts note that this year is far from typical. The first truly cold winter since Europe lost most of its pipeline gas supply from Russia depleted reserves more rapidly than usual. The situation was further exacerbated when Ukraine halted the remaining transit flows on January 1. The resulting market squeeze has led to a persistent rise in summer gas prices, which have now surpassed next winter's prices.

A key question now is what role governments will play in ensuring storage is replenished. State intervention could range from direct subsidies for producers and consumers to the establishment of strategic reserves and export restrictions. Each of these options comes with trade-offs. Subsidies may encourage production and lower costs for consumers, but they can also distort the market and lead to inefficient resource allocation.

There is still ample time before the next winter season, but many market participants believe that the first few weeks of April will offer a clear indication of whether stakeholders are ready to begin restocking despite the unfavorable price structure, or whether they intend to wait for more advantageous market conditions.

The stakes are high. If the European Union enters the next winter with partially filled storage, the region could face a sharp spike in prices in the event of severe cold or other unexpected disruptions. European Commission rules stipulate that storage facilities must be 90% full by November 1. However, recent proposals and discussions about introducing flexibility in the timeline for reaching these targets have created significant uncertainty. This has caused price fluctuations and left traders guessing about how the rules will ultimately be applied.

Gas futures declined amid speculation that storage targets might be relaxed, along with optimism about a possible resolution to the conflict in Ukraine. According to some economists, gas prices are currently about 50% higher than a year ago. The price—just above €40 per megawatt-hour—is expected to remain at or above current levels over the next few weeks, depending heavily on liquefied natural gas (LNG) demand this summer.

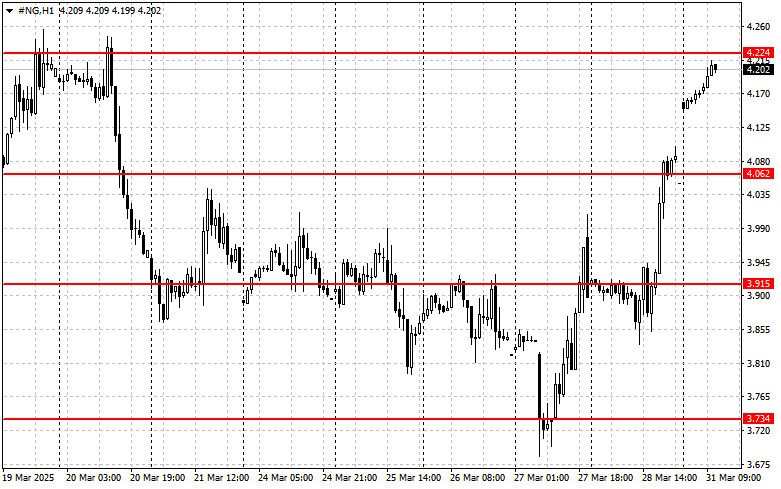

Regarding the technical outlook for natural gas (NG), buyers are now focused on reclaiming the 4.224 level. A breakout above this range would open a direct path toward 4.373 and the more significant resistance at 4.502. The furthest upside target lies in the 4.600 area. On the downside, initial support stands around 4.062. A breakdown below this level would likely send the instrument lower to 3.915, with the most distant bearish target located near 3.734.

MobileTrader: trading platform near at hand!

Download and start right now!

You have already liked this post today

*Disclaimer: The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have any content questions, please contact editorial-board@instaforex.com

If you have any content questions, please contact editorial-board@instaforex.com

There are relatively few macroeconomic events scheduled for Thursday, but that no longer matters much. Yesterday, there were plenty of important publications from the Eurozone, Germany, and the U.S. Even

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.