Bitcoin optimistically started a new trading week, recovering above $42k by the end of Monday. The asset continues its upward movement, and on January 30, it experienced a bullish breakthrough of the $43k resistance level, indicating significant bullish sentiment in the crypto market. The recent bullish momentum has largely been possible due to the absence of important macroeconomic and other factors influencing the cryptocurrency market.

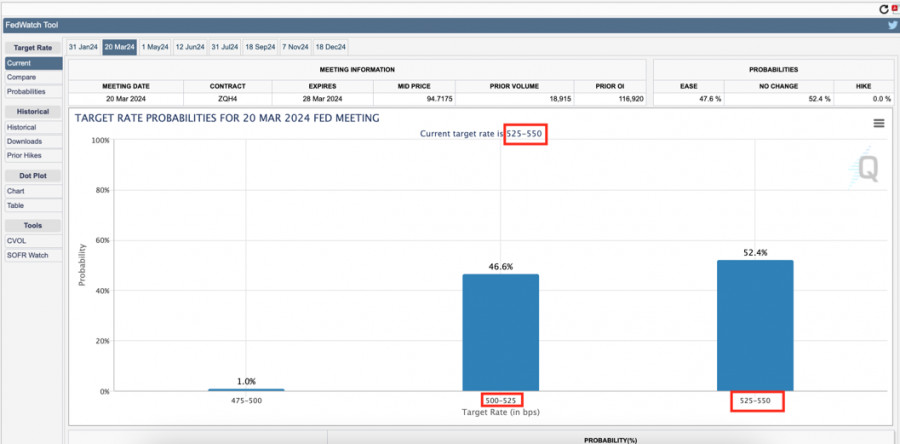

However, the last two days of January promise to bring a substantial amount of crucial macroeconomic data to financial markets, directly impacting the quotes of investment assets. In anticipation of the scheduled Federal Reserve meeting tomorrow, investors will analyze information on the labor market and the number of new job openings in the United States. Also, on January 30, a report on consumer confidence levels will be published, potentially causing volatility in investment markets and leading to powerful price movements.

Fundamental Factors

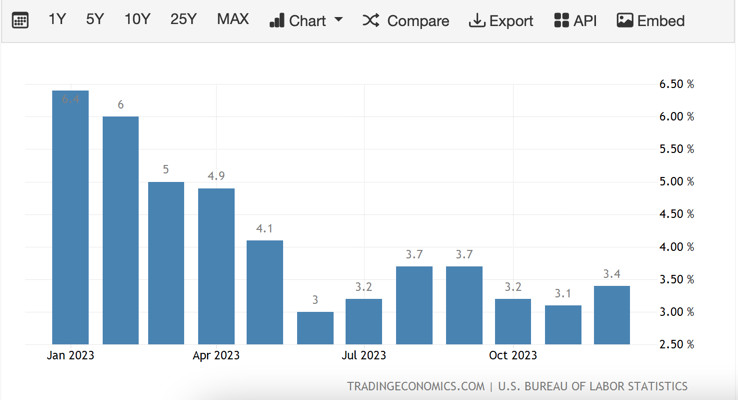

Following the rise in inflation levels in December, investors realized that a swift transition to monetary policy easing is not anticipated. Therefore, financial markets are trying to assess what to expect from Fed Chairman Jerome Powell's rhetoric after tomorrow's meeting. Labor market data and the number of new job openings can shed light on this question and provide insights into the state of the U.S. economy, making them crucial for investors.

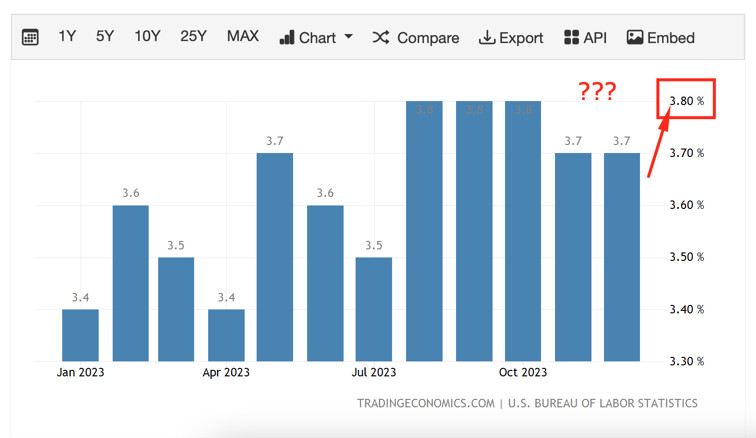

Today, at 15:00 GMT, data from the Bureau of Labor Statistics will be released, allowing investors to evaluate the outlook for changes in the U.S. labor market by the end of January. The forecast indicates that in January, the U.S. economy included 8.73 million active job vacancies, compared to 8.79 million in December. If the data confirms this, an increase in the unemployment rate in January to 3.8% from the initial 3.7% can be expected, signaling the need to stimulate the U.S. economy.

Also at 15:00 GMT, a report on the Consumer Confidence Index will be published, acting as a leading indicator pointing to the likely inflation level in January. Forecasted data suggests a probability of an increase in the Consumer Confidence Index in January to 114.2 points, compared to 110.7 points in December. In such a scenario, the U.S. dollar index will receive support, and crypto assets will begin to decline amid the high likelihood of a more stringent stance from Powell's speech on January 31.

Overall, investors remain in a nervous state of uncertainty because there is no basis to believe that monetary policy easing could begin as early as March. Moreover, there are reasons to believe that with sustained growth in key indicators, including the inflation rate, another interest rate hike is possible. If today's data confirms concerns about the likely inflation increase in January, Powell may announce that the Fed is considering another interest rate hike.

BTC/USD Analysis

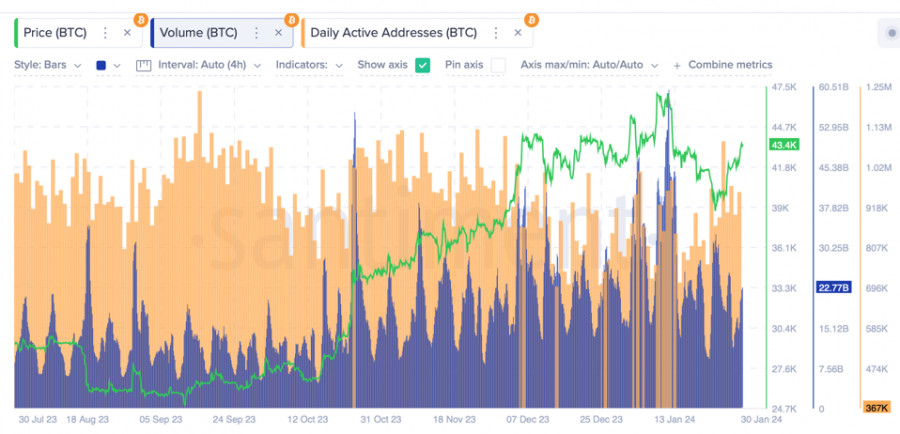

Despite potential challenges, Bitcoin continues its upward movement, completely nullifying the structure of the local downward trend. The primary target for the asset is the $45k level, where the 0.618 Fibonacci retracement is located, marking the end of the cryptocurrency's corrective movement within the medium-term downward trend. If BTC/USD consolidates above the $45k level and continue its upward movement beyond $46k, an update of the local high can be expected.

As of January 30, Bitcoin is confidently approaching this target, achieving a bullish breakthrough of the $43k level with daily trading volumes around $22.6 billion. Active purchases are gradually resuming, including those from giants like BlackRock, which has increased its total BTC reserves to 52,025 BTC. Moreover, increasing evidence suggests that the decline in the price of Bitcoin was triggered by Grayscale, whose total BTC balances fell from 620,000 to 502,000 BTC.

Bitcoin has closely approached the 0.5 Fibonacci level near the $43.4k mark. The asset is likely anticipating consolidation or a decline here, depending on the market's reaction to fundamental factors. A final reversal in the BTC/USD price and the completion of the upward correction of the asset are also possible at this point. If the price of Bitcoin starts to decline and breaks the $42.6k level, the cryptocurrency will continue to fall below $40k. With successful consolidation and a further break above $43.4k, the likelihood of establishing itself above $45k will significantly increase.

Conclusion

Bitcoin continues its upward movement, which may be either strengthened or completely broken by the fundamental macroeconomic data in the next two days. Expect increased volatility and powerful price movements. Tomorrow's Federal Reserve meeting is one of the most anticipated and, at the same time, unpredictable events. The macro data on January 30 will be of great importance for BTC investors in the medium term, and therefore, the first price impulses can be expected today.