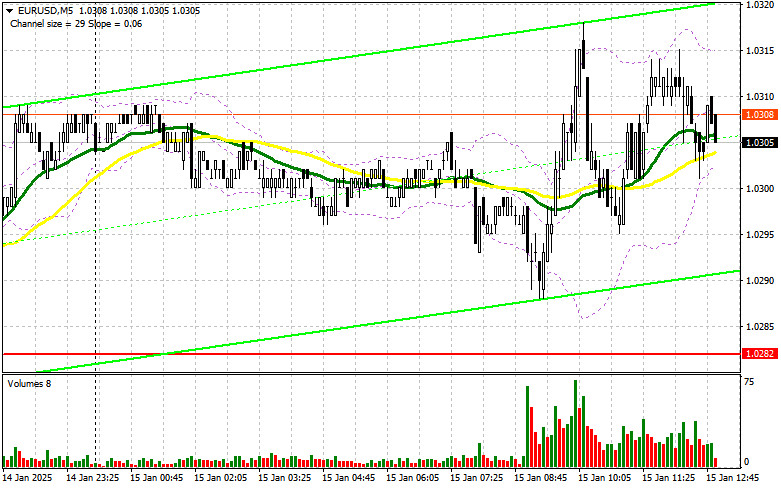

In my morning forecast, I highlighted the level of 1.0324 as a critical decision point for market entry. Let's look at the 5-minute chart to analyze what happened. The rise occurred, but the test of this range and the formation of a false breakout fell short by just a few points, leaving me without trades during the first half of the day. The technical picture for the second half remains unchanged.

For Long Positions on EUR/USD:

The clear absence of important statistics from the Eurozone and the anticipation of significant US inflation data has pushed traders into a wait-and-see mode. This has significantly affected volatility and trading volume, preventing suitable market entry points. The situation could change drastically in the second half of the day, with US December inflation figures expected to heavily influence the Federal Reserve's monetary policy plans.

- If inflation rises, the dollar is likely to strengthen as it delays plans to cut interest rates further.

- If inflation slows, the euro may continue to strengthen as lower price pressure could expedite the easing of monetary policy.

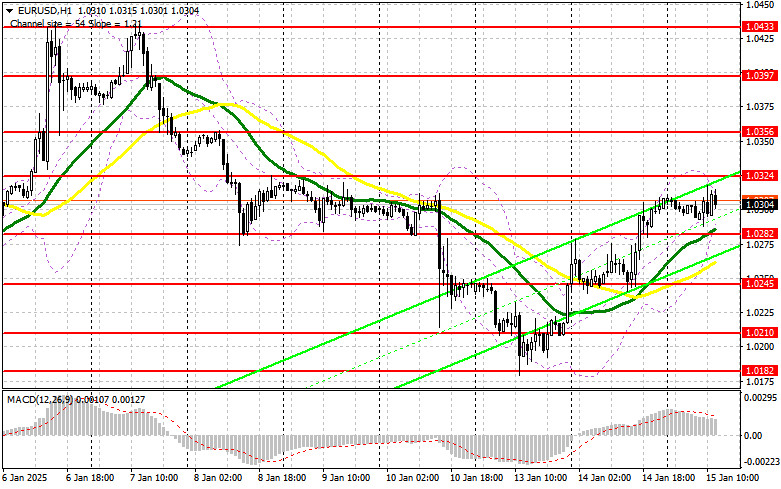

In the event of renewed pressure on the pair, I plan to act only around the nearest support level of 1.0282, which was not tested during the morning session. A false breakout at this level will provide a solid entry point for buying, targeting resistance at 1.0324. A breakout and subsequent retest of this range will confirm the entry point for buying with an exit target of 1.0356. The furthest target will be the 1.0397 maximum, where I plan to take profits. If EUR/USD declines on strong US data and there is no activity near 1.0282, the pair could face significant pressure, with sellers pushing it down to 1.0245. Only a false breakout at that level will provide a reason to buy the euro. Immediate long positions will be considered at the 1.0210 minimum for an intraday upward correction of 30-35 points.

For Short Positions on EUR/USD:

Sellers remain relatively inactive as all eyes are on the upcoming US inflation data and Federal Reserve speeches. If the pair surges following the data release, only a false breakout around 1.0324 will convince me of significant market player presence, providing a short entry point targeting the 1.0282 support level, where moving averages currently support buyers. A breakout and subsequent retest of this range from below will be another strong signal to sell, aiming for a move towards the 1.0245 minimum, which would reestablish the bearish trend. The ultimate target will be the 1.0210 level, where I plan to take profits.

If EUR/USD rises in the second half of the day without active bearish resistance around 1.0324, I will postpone short positions until the next resistance at 1.0356. Short positions will also be opened there only after an unsuccessful consolidation. If no downward movement occurs at that level, I plan to open shorts from 1.0397, aiming for an intraday correction of 30-35 points.

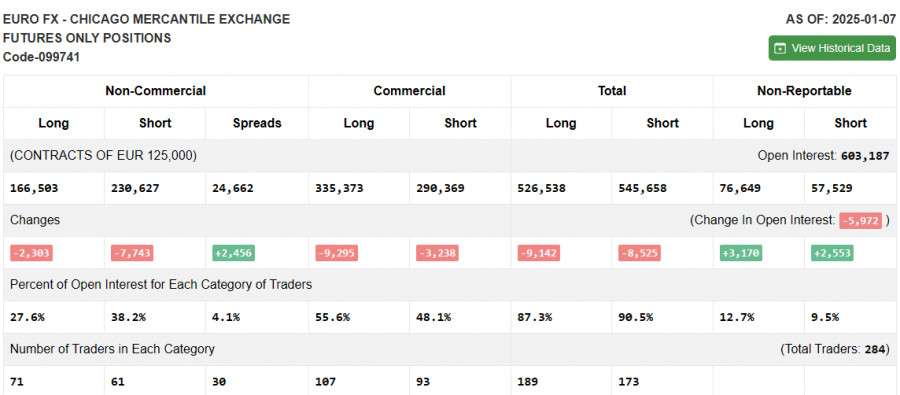

The Commitment of Traders (COT) report for January 7 showed reductions in both long and short positions. With the Federal Reserve's rate cuts likely postponed until the fall, this points to strong US dollar positioning in the medium term. If upcoming US inflation and GDP data indicate growth, this will be another reason for increasing long positions on the dollar.

The COT report showed that long non-commercial positions decreased by 2,303 to 166,503, while short non-commercial positions fell by 7,743 to 230,627. As a result, the gap between long and short positions widened by 2,456.

Indicator Signals:

Moving AveragesTrading is conducted above the 30- and 50-day moving averages, indicating further correction of the pair.Note: Moving average periods and prices are based on the author's hourly H1 chart analysis and differ from the classic daily D1 moving averages.

Bollinger BandsIn case of a decline, the lower boundary of the indicator around 1.0282 will act as support.

Indicator Descriptions:

- Moving average (MA): Indicates current trend by smoothing out volatility and noise. Period – 50 (yellow on the chart); Period – 30 (green on the chart).

- MACD (Moving Average Convergence/Divergence): Indicates divergence between fast (EMA-12) and slow (EMA-26) moving averages. SMA period – 9.

- Bollinger Bands: Identifies volatility and potential reversals. Period – 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and institutions using the futures market for speculative purposes.

- Non-commercial long positions: Total long open positions held by non-commercial traders.

- Non-commercial short positions: Total short open positions held by non-commercial traders.

- Net non-commercial position: Difference between non-commercial short and long positions.