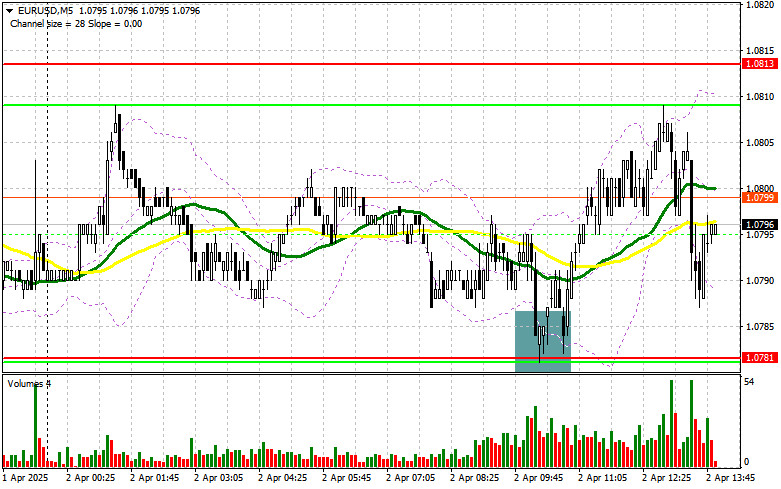

In my morning forecast, I highlighted the 1.0781 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and break down what happened. A decline and the formation of a false breakout at that level provided a good entry point for long positions, which resulted in a 30-point rise in the euro. The technical picture has not been revised for the second half of the day.

To open long positions on EUR/USD:

Given the lack of statistical data, relatively active buying around 1.0781—the previous day's low—was fairly expected. However, things may change in the second half of the day. We're expecting U.S. ADP employment change data and factory orders. The speech by FOMC member Adriana D. Kugler is unlikely to attract much attention, as the market focus will be on Trump's speech and the announcement of reciprocal tariffs, for which no details have been provided yet. Only a softer tariff format could help risk assets recover.

If the euro falls after the data releases, only a false breakout near the 1.0781 support area will provide a reason to buy EUR/USD in anticipation of a bullish rebound with a target of 1.0813. A breakout and retest from above would confirm the correct entry point, opening the path to 1.0848. The ultimate target will be the 1.0884 area, where I will take profits.

If EUR/USD declines and there is no activity around 1.0781, pressure on the euro will increase sharply. In that case, sellers could push the pair to 1.0757. Only after a false breakout there will I consider buying the euro. I plan to buy immediately on a rebound from 1.0736 for an intraday correction of 30–35 points.

To open short positions on EUR/USD:

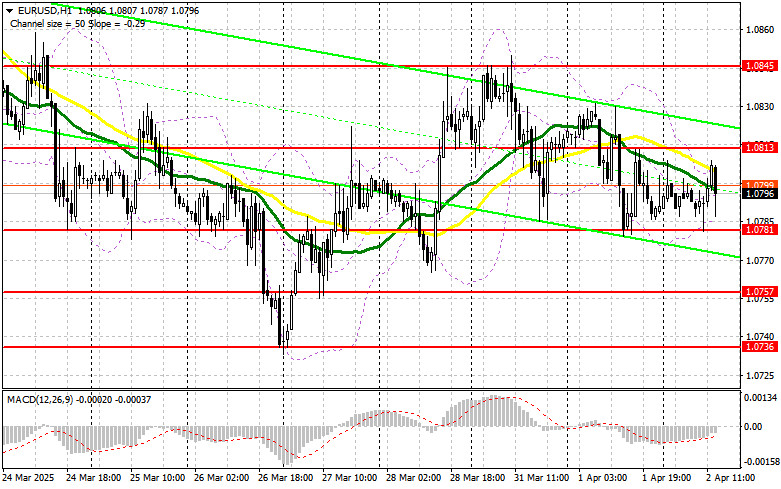

Sellers are still waiting, and only more aggressive tariffs from Trump can bring new players into the market betting on a stronger dollar. In case of a negative reaction to the ADP data, only a false breakout near the 1.0813 resistance will allow for short positions, aiming for another decline toward 1.0781 support.

A breakout and consolidation below this range will be a solid sell signal with a move toward 1.0757. The final target will be the 1.0736 area, where I will take profits.

If EUR/USD rises in the second half of the day after the data and Trump's speech, and bears are inactive near 1.0813—where moving averages are located—buyers could push the pair higher. In this case, I'll delay shorts until the next resistance at 1.0845, selling only after a failed breakout. If no downward movement happens there either, I'll look for shorts on a rebound from 1.0916, targeting a 30–35 point correction.

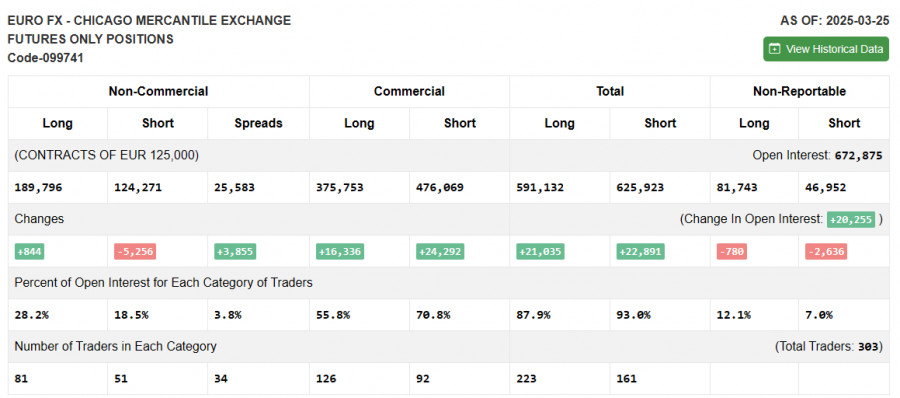

Commitment of Traders (COT) Report:

The March 25 COT report showed a modest increase in long positions and a significant reduction in shorts. There's no noticeable increase in euro buyers, but sellers are clearly retreating. Considering recent inflation data in the eurozone and ECB officials' comments, the regulator's stance at the upcoming April meeting will likely remain unchanged, which could temporarily support the euro.

However, much will depend on the impact of U.S. tariffs on other countries. The more serious the threat to global economic growth, the greater the pressure on risk assets, including the euro.

According to the COT report, long non-commercial positions rose by 844 to 189,796, while short non-commercial positions dropped by 5,256 to 124,271. The gap between long and short positions increased by 3,855.

Indicator Signals:

Moving Averages: Trading is around the 30- and 50-period moving averages, indicating a sideways market.

Note: The period and prices of moving averages are based on the H1 chart and may differ from the classic daily moving averages on the D1 chart.

Bollinger Bands: In case of a decline, the lower boundary of the indicator near 1.0781 will act as support.

Indicator Descriptions:

- Moving Average: Smooths volatility and noise to define the current trend. Period 50 (yellow), Period 30 (green).

- MACD (Moving Average Convergence/Divergence): Fast EMA – 12, Slow EMA – 26, Signal SMA – 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes under specific requirements.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Total non-commercial net position: The difference between short and long non-commercial positions.