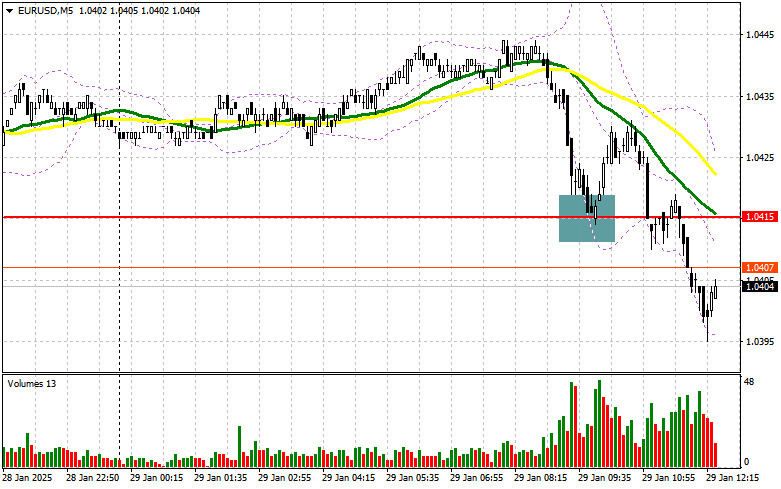

In my morning forecast, I highlighted the 1.0415 level as a key point for making trading decisions. Let's examine the 5-minute chart to analyze what happened. A decline and false breakout around 1.0415 created a good buying opportunity, leading to a 15-point increase before renewed selling pressure pushed the pair lower. The technical outlook for the second half of the day remains unchanged.

Long Position Strategy for EUR/USD

Given weak German economic data and a decline in eurozone lending, the euro quickly dropped back to 1.0415 and broke below this level on its third test. A clear risk-off sentiment is evident ahead of the Federal Reserve's rate decision.

During the U.S. session, market participants will be closely watching the FOMC interest rate decision, which is expected to remain unchanged, along with the accompanying statement. Afterward, Fed Chair Jerome Powell will provide insights into the central bank's future stance on interest rates and whether rate cuts are on the table.

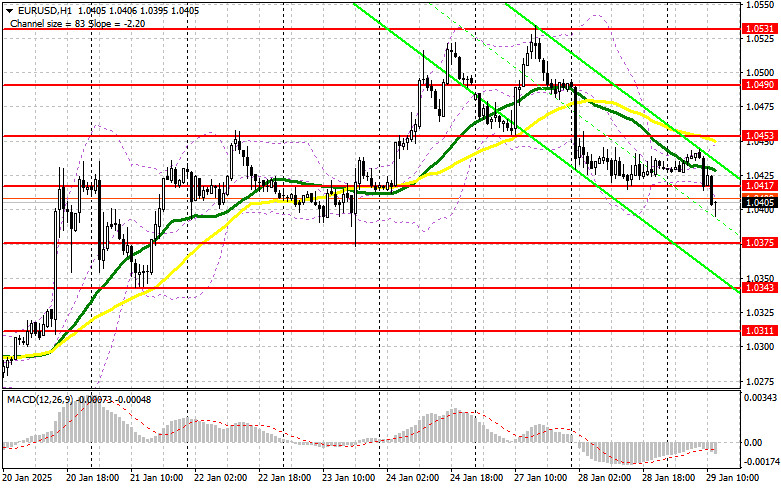

A wait-and-see approach from the Fed is likely to increase demand for the U.S. dollar, leading to further euro depreciation. If the market reacts negatively to the FOMC decision, I plan to enter long positions at the 1.0375 support level. A false breakout at this level would provide a buying signal, targeting the 1.0417 resistance level, which formed in the first half of the day.

A break and retest of 1.0417, combined with a dovish Fed outlook, would confirm a valid buying entry, aiming for 1.0453—a key level where bullish momentum could strengthen. The final upside target is 1.0490, where I will take profit.

If EUR/USD falls further and there is no buying activity at 1.0375, the pair risks extending losses to 1.0343. Only a false breakout at this level will prompt me to go long. Alternatively, I will buy on a rebound from 1.0311, targeting a 30-35 point intraday correction.

Short Position Strategy for EUR/USD

Sellers successfully broke below 1.0415 on their third attempt, which was not surprising. Their primary target now is to secure this level as resistance.

If the pair rises before the Fed decision, a false breakout at 1.0417 would confirm the presence of large market players, offering an entry for short positions, with a target of 1.0375 (which has yet to be tested).

A break and consolidation below 1.0375, followed by a retest from below, would provide an additional sell signal, leading to a decline toward 1.0343. The final bearish target is 1.0311, where I will take profit.

If EUR/USD rises in the second half of the day and bears fail to act at 1.0417, where the moving averages are also located, I will postpone short positions until the 1.0453 resistance test. I will sell from this level only after a failed breakout attempt. Alternatively, I plan to short from 1.0490 on a rebound, targeting a 30-35 point downward correction.

Commitments of Traders (COT) Report

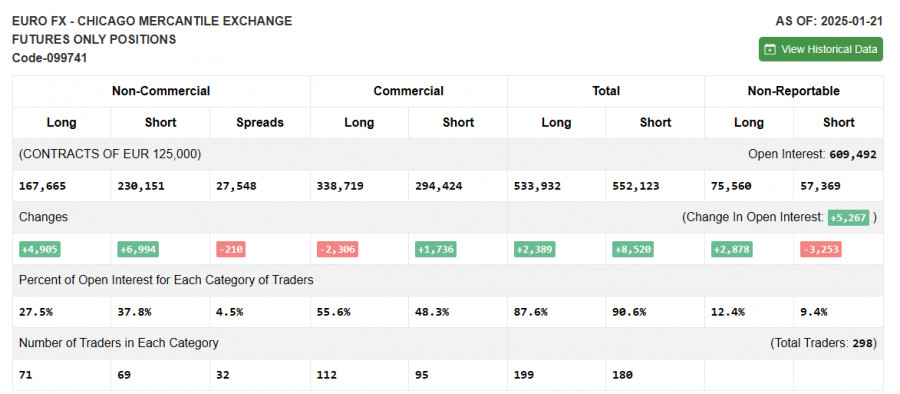

The January 21 COT report showed an increase in both long and short positions, keeping the overall market sentiment unchanged.

Traders continue to favor short positions on the euro, as they expect that sooner or later, Trump's rhetoric will translate into action, which could lead to significant dollar appreciation against the euro. The Fed's future policy remains uncertain, but the FOMC meeting could strengthen the dollar's position.

According to the COT report, non-commercial long positions increased by 4,905 to 167,665, while short positions rose by 6,994 to 230,151. As a result, the gap between long and short positions narrowed by 210.

Indicator Signals

Moving Averages

EUR/USD is trading below the 30- and 50-period moving averages, which maintains bearish pressure on the pair.

Note: The moving averages discussed refer to the H1 chart and may differ from classic daily moving averages (D1).

Bollinger Bands

If the pair declines, the lower Bollinger Band at 1.0400 will act as support.

Indicator Descriptions

- Moving Average (MA): Determines the current trend by smoothing out volatility and market noise.

- 50-period MA (Yellow)

- 30-period MA (Green)

- MACD (Moving Average Convergence/Divergence)

- Fast EMA – Period: 12

- Slow EMA – Period: 26

- SMA – Period: 9

- Bollinger Bands: Period – 20

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculation.

- Long non-commercial positions: Total long positions held by non-commercial traders.

- Short non-commercial positions: Total short positions held by non-commercial traders.

- Net non-commercial position: The difference between long and short positions held by non-commercial traders.