While Europe and parts of Asia continue celebrating Easter and political life has temporarily paused, in the U.S., the "Make America Great Again" trend set by Donald Trump continues to gain momentum. If anyone still hoped that the situation would stabilize after the President decides to delay the imposition of sweeping tariffs, last week demonstrated that such hopes are premature.

The chaos initiated by the U.S. — specifically by Trump — persists. And while it may not be entirely out of control, it's impacting asset values and overall market sentiment. Last week, even the Federal Reserve, via Chair Jerome Powell, was in the spotlight.

Once again, Trump urged the Fed to continue lowering interest rates despite renewed inflation risks. Given the President's aggressive push to achieve his goals, investors saw this pressure as a sign that further rate cuts are likely. Against this backdrop, and after the long Easter weekend, the U.S. dollar came under intense pressure again. Its decline resumed during today's Asian trading session. Rate cuts by the European Central Bank and other central banks are no longer sufficient to halt the drop in demand for the dollar.

What's driving this?

The main reason is the nearly panicked flight from risk assets — especially U.S. stocks. Investors fear the sharp shift in the political and economic paradigm under the current U.S. administration will severely harm the national economy and drag the global economy into a prolonged and painful recession. This would suppress business activity in the real economy and reduce demand for both equities and commodities. In such a scenario, the classic strategy kicks in: when you can't see a clear path ahead — especially in the U.S. — you dump dollar assets, stocks, and the dollar itself.

This doesn't mean the euro or pound is in significantly better shape. Economic conditions in the Eurozone and the UK are arguably worse than in the U.S.

The drop in demand for "everything American" — including stocks and the dollar — results from the prior massive inflows of foreign capital into these assets. The U.S. stock market had been rising almost vertically, with strong demand for treasuries that supported the dollar. Investors had hoped the "Biden-era economic machine" would continue operating, merely adjusted by Trump's reforms — but that didn't happen. The 47th president opted for a complete overhaul of the previous economic structure. The uncertainty over the eventual outcome is precisely causing today's market instability.

Returning to the dollar, it is currently trading just above 98.00 on the ICE index and is likely to continue declining once that level is broken.

Now, for a second — less apparent — the reason behind the dollar's weakness is Trump's clear intent to weaken the dollar against all major currencies (not just those). It's impossible to boost exports and domestic manufacturing with a strong dollar. To make American goods competitive globally, the currency must fall — something easily achieved through interest rate cuts, precisely what Trump is pushing for.

Given everything happening in the markets, I believe the ICE dollar index will fall below 98.00 this week and may test support at 96.50 by week's end. Cryptocurrencies are likely to rise modestly, supported by dollar weakness, but strong growth is unlikely. Their sensitivity to external negativity may cause this rebound to stall in the next day or two.

Gold prices have again soared amid persistent fears and uncertainty. A new all-time high at 3400.00 could be reached soon, possibly today or tomorrow after a brief correction.

In general, current market conditions are likely to persist — unless Trump makes a significant shift in his geopolitical and economic policies.

Daily Forecasts:

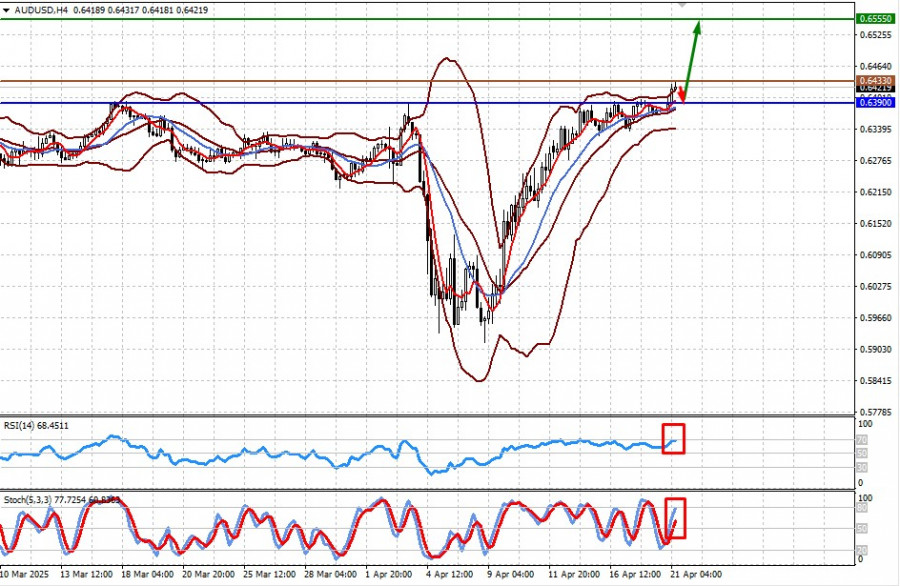

AUD/USD

The pair has broken above the resistance level of 0.6390. Positive news from China about its central bank maintaining a supportive monetary policy — coupled with dollar weakness — may support the pair and push it higher after a brief pullback to 0.6555. A potential entry point for buying could be the 141.14 level.

USD/JPY

The pair has dropped below the strong support level of 141.65. Dollar weakness and the likelihood of further U.S. rate cuts — contrasted with a potential rate hike in Japan — put pressure on the pair. If these trends continue, USD/JPY may fall first to 140.00 and then to 138.80. A possible entry point for selling could be the 1594.18 level.