On Thursday, the Swiss National Bank will reveal the outcomes of its regular meeting. This particular June meeting is anticipated to deviate from the norm. According to most analysts, the central bank will likely raise the interest rate by 25 basis points to 1.75%. However, some experts believe the SNB might take a more aggressive approach and increase the rate by 50 basis points. While the first scenario is predicted to moderate the EUR/CHF pair, the more hawkish scenario could strengthen the Swiss franc against the euro.

Inflation and the SNB

There is almost a 100% likelihood of an SNB rate hike in June. The discussion revolves around the extent of the increase and the prospects of monetary tightening. The rate hike itself is not in doubt, especially after recent statements made by Thomas Jordan, the head of the Swiss central bank. Jordan emphasized the importance of reducing inflation in the country to achieve price stability. He also highlighted that the central bank does not need to wait for inflation indicators to accelerate before raising the interest rate, emphasizing the need for preemptive action.

It is important to remember that the SNB has been gradually increasing the rate since March 2022, from -0.75% to the current level of 1.50%. Therefore, Jordan's statement that the central bank should not wait for inflation to rise should not be interpreted literally. It signifies a refusal to adopt a wait-and-see approach and indicates further actions, despite the downward trend in inflation indicators.

The report on consumer price index (CPI) growth published in early May indicates that inflation in Switzerland is primarily driven by increases in domestic tariffs following the stabilization of prices for energy and imported goods.

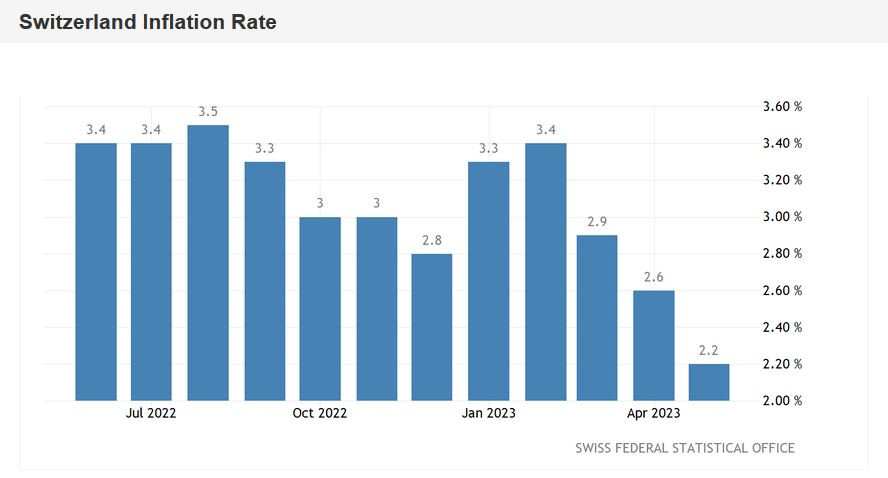

According to the released data, the overall consumer price index decreased to 2.2% in May on a year-on-year basis. For comparison, the overall CPI stood at 3.4% at the beginning of the year, while in the previous reporting month (April), it was at 2.6%. The core index, which excludes volatile energy and major food product prices, decreased to 1.9% in May. This reflects a downward trend, as the April figure was 2.2%.

The increase in inflation can be attributed to higher rental costs, tourist packages, and certain food products. However, tariffs for air transportation, heating, and diesel fuel had a dampening effect on inflation.

On the one hand, the overall and core consumer price indices show a downward trend. On the other hand, the current level of inflation does not satisfy the SNB. A few weeks ago, Thomas Jordan stated that the central bank could not allow consumer price growth rates to remain above 2% for too long. This is another hawkish signal from the head of the SNB, indicating the central bank's readiness to further tighten monetary policy, at least in the context of the June meeting.

It is worth noting that Switzerland's pace of consumer price growth remains the slowest among all developed countries in the Organization for Economic Cooperation and Development (OECD). Considering this factor and the actual slowdown of the CPI in Switzerland in May, there is a possibility that the SNB's post-meeting rhetoric will suggest a "concluding" nature. In other words, the central bank will raise the rate but not announce further tightening monetary policy.

Possible scenarios

According to experts at Credit Suisse, two potential scenarios exist. The first scenario, with an estimated probability of around 40%, entails a simultaneous 25-point rate hike accompanied by a suggestion of a potential conclusion to the current monetary policy tightening cycle. In this case, the Swiss franc is expected to face pressure across the market, primarily against the euro, as the European Central Bank maintains a hawkish position.

The second scenario, with an estimated probability of 60%, also involves a 25-point rate hike, but the SNB maintains a hawkish stance and effectively announces further steps toward tightening monetary policy.

If the first scenario materializes, the EUR/CHF pair will experience an upward surge, potentially reaching at least the 0.9850 level (the upper boundary of the Kumo cloud on the daily chart). From a medium-term perspective, the pair may even reach the 99-figure boundary.

If the second scenario unfolds, bears in the EUR/CHF pair may briefly take control, causing the price to drop towards the 0.9750 level (where the Tenkan-sen and Kijun-sen lines coincide on the D1 timeframe). In this case, the downward correction is an opportunity to open long positions with targets at 0.9800 and 0.9850.

A reversal of the current upward trend would only be possible if there is a 50-point rate hike while maintaining a hawkish stance. Although such a scenario is unlikely, its realization would enable bears in the EUR/CHF pair to establish a sustained downward movement toward the 96-figure area.